PREVENTATIVE CARE PROGRAM

- This service delivers next-gen employee preventive care through smart technology, real-time health insights, and seamless access to proactive support.

- It is a powerful program that saves a company $640 per employee annually in FICA taxes. Additionally, the company offers an impressive employee benefits program with numerous wellness perks.

- And the best part? It’s cost-neutral to the company and the employee.

TECHNOLOGY AUDIT & ANALYSIS

- Trusted technology broker conducts a no-cost audit and analysis

- Access to 1000+ pre-vetted U.S. & International carriers and providers

- Customized design for a company’s unique environment

- Full service implementation and ongoing management

- Best fit, carrier-agnostic solutions

- 30+ years of experience

- Single point of contact and support

REVENUE CYCLE MANAGEMENT

This service provides comprehensive Revenue Cycle Management (RCM) services to healthcare providers across the United States, helping practices streamline billing, coding, claims processing, and accounts receivable to improve financial performance and cash flow.

Their solutions include accurate medical billing and coding, denial management, credentialing and enrollment, eligibility verification, patient billing and collections, and other support services designed to reduce administrative burden, minimize errors, accelerate reimbursements, and maximize revenue for hospitals, clinics, and medical practices while ensuring compliance and operational efficiency.

DEBT RESOLUTION

Debt Resolution is a powerful program that addresses one of the biggest challenges in America today—financial stress caused by overwhelming debt.

- Offers tailored debt solutions to help reduce payments, settle accounts, and achieve financial stability.

- Connects individuals with legal and financial specialists who renegotiate debt and protect consumer rights.

- Possible solutions include: Debt resolution, student loan forgiveness, debt settlement, and debt consolidation.

- Provides a free confidential consultation to understand an individual’s situation, a customized debt strategy, execution, and ongoing support.

THE LENDING CENTER

- Next-gen employee wellness made simple – This program delivers preventive care through innovative technology, real-time health insights, and seamless access to proactive support.

- Significant savings for companies – It reduces FICA taxes by $640 per employee annually while providing a robust employee benefits program with wellness perks that boost satisfaction and retention.

- Cost-neutral for everyone – Employees enjoy enhanced benefits at no cost, and the company gains financial and wellness benefits. A win-win solution.

Business Process Automation

We bring enterprise-level business process automation to the small and medium-sized business market with no upfront implementation costs and no need for internal IT or engineering resources.

Business process automation uses technology and software to automate and streamline business processes, eliminating manual tasks and reducing human intervention. We all know this is crucial in today’s business landscape by driving efficiency, reducing errors, cutting costs, enabling scalability, and increasing visibility. Embracing automation can give businesses a competitive edge and position them for success in an increasingly digital and fast-paced world.

Small and mid-size businesses often face several challenges when automating manual workflows. These can include cost and resource constraints, limited ability to leverage technology for business growth and efficiency, and human tasks that can lead to errors, delays in operations, and reduced visibility into the work done. They must improve their ability to seize growth opportunities and meet customer demands. Addressing these challenges is where we come in. The business can focus on the most critical and high-value tasks by automating manual processes and providing support, continuous management, and maintenance of the automation.

Same Day Delivery

A solution that empowers brick-and-mortar retailers to compete in same-day delivery. A low fixed-rate enables retailers of all sizes to cost-effectively satisfy consumer demand for same-day delivery.

Shipping

Although a company’s shipping costs may consume five to ten percent of their annual revenue, few companies have the time or tools to effectively manage this expense. Shipping carriers have made this process unnecessarily complex, leading to overspending on shipping and a competitive disadvantage.

We’ve changed the game… introducing a cutting-edge shipping execution platform, at no cost to our clients who qualify, combined with exclusive rates and cost savings strategies that they cannot find anywhere else. Our system doesn’t simply print labels, it’s a completely automated, multi-carrier shipping technology that continuously optimizes your shipments to identify savings opportunities within your small parcel and LTL shipments. You can keep your current carriers and load them right into our shipping platform.

Our proprietary software, combined with over two hundred million parcels shipped annually, through more than twenty thousand clients, gives you access to rates that companies can only dream of. By using our software, our clients see anywhere from 15% to 40% savings on their shipping spend while enjoying a more efficient and streamlined workflow process in their shipping operations.

Health Benefits Cost Reduction

Employee health benefits ranks as the 2nd largest expense for the average employer, second only to payroll, and the rising cost of employee health benefits is the number one issue, or problem employers are facing today. Every they are face with a choice of paying significantly more, or reducing benefits and paying slightly more.

We have a healthcare billing problem in the United States. The price for medical services and the price of prescription drugs, depends on how much can be extracted from you, or from your health plan, and you have no idea how much the bill is going to be until after services are rendered. The patient that comes in right after you could be paying one tenth of what you are paying, or ten times what you are paying, depending on their health plan. Could you imagine if you were to go into a grocery store, nothing had a price tag, and everyone had a different price to pay at the register? That’s healthcare.

We focus controlling the costs of the four primary cost drivers which make up 90% of the cost of a health plan: hospitalization & surgery, outpatient services, including diagnostic labs & imaging, emergency services, prescription drugs, and physician services. Our direct primary care strategy with concierge medicine, provides a noticeable increase in access to care while serving to help bring price transparencies, and deep additional discounts for hospitalization, Surgery, outpatient services, labs, imaging, emergency services, drugs, and physician services.

We help organizations to reduce the cost of their employees’ health benefits by 12 to 25%, and sometimes more, while reducing their employees’ out of pocket costs, and increasing their quality of care without necessarily changing their broker or health plan provider. With nearly a 100% success rate, and fees contingent on results, your clients will forever love you for the savings

Accounts Payable – Virtual Payments

Up until now, the cost of operating a company’s accounts payable function, has been a necessary expense. After all, no one could expect the department that is responsible for making payments, to also generate revenue. That is, up until now.

For businesses that manually process hundreds of invoices each week, the benefits of transitioning to virtual payments is huge. Virtual payments, is not only easier, than checks and ACH, it’s faster. And added speed ultimately means added savings.

Our FREE automated virtual payment solution works with an organizations existing accounting software, streamlines their current procedures, and not only saves: time, money, and paper, but actually pays them a rebate for each virtual payment made.

Our Virtual Payment platform works with their existing accounting software, and there’s no need to change banking relationships. Virtual Payments will save their organization both time and money, and Virtual Payments pays them revenue for every transaction. How much revenue? Every $10 million in Virtual Payments could add $135,000 in additional revenue to their bottom line.

Businesses have to pay your suppliers anyway, so why not turn their Accounts Payable into additional revenue.

Advisors are paid a residual income, on each business, every month they are using virtual payments. You are paid off the transactions not the savings!!!

Zero Cost Processing

For any business that accepts payment for goods or services by credit card, they can now recover back 1% to 4% of their gross sales amount by no longer having to pay for the merchant service processing charges of the transaction.

In the wake of the $5,000,000,000+ class action law suit against the big names in merchant services comes a solution to prevent future overcharging, specifically…don’t be charged at all!

THE RULES HAVE CHANGED for accepting credit cards. Advances in technology, combined with most states in the country which have now approved this, means that companies that sell their goods or services can now apply any merchant processing fees of processing credit cards as a fee to the buyer at time of sale. This is only for processing credit cards, and does not apply to debit card transactions (which have a significantly lower processing cost).

Our special team handles everything needed to properly set up the business to take advantage of this new change, from technology, to disclosure signage, to training of the client and their staff.

Once the client’s company is on this new system the only difference they will notice is an additional 1% to 4% added to the profits of credit card sales.

This is a unique service which is just starting to emerge as an option for businesses in the United States. The advisor is paid a residual income on each business every month they are processing credit card transactions. You are paid off the transactions not the savings!!! Imagine being able to say to your client, “You know those merchant processing fees you have to pay? You don’t have to pay those anymore”. Business owners now have the option to not have to pay merchant processing fees. So we can either lower clients credit card processing fees with our credit card audit program above or with Zero Cost Credit Processing we can eliminate their fees so either way you and your client win.

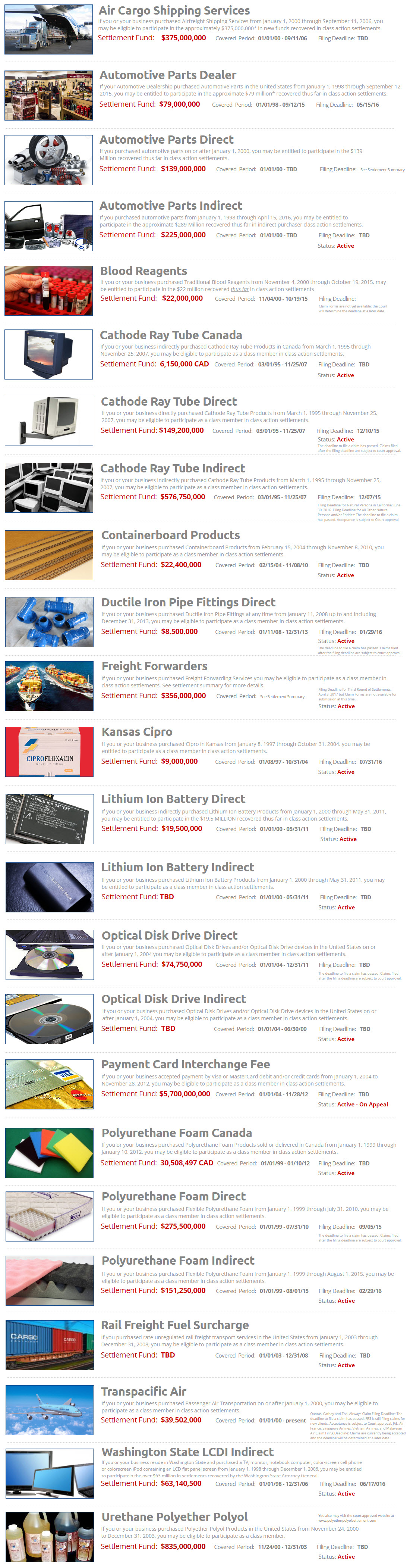

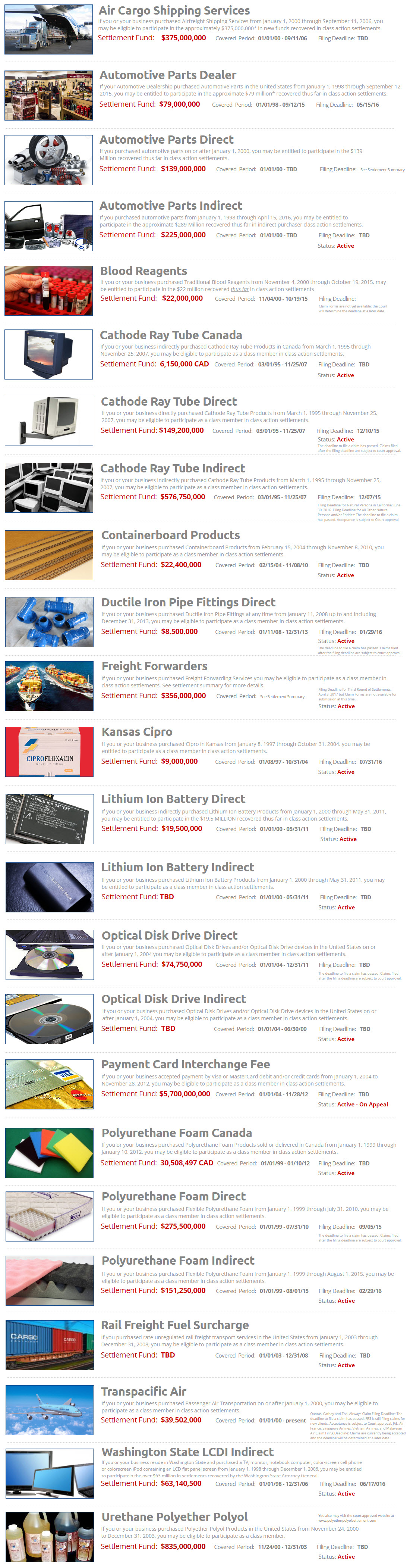

Class Action Claims Consulting

One of our newest service additions has become one of the best ways to get in front of business owners anywhere in the country. Class action settlement claims consulting provides your clients with the ability to obtain their fair shares of consumer and antitrust class action recoveries.

Through strategic relationships, we provide:

- Access to a custom CRM which is able to be pre-loaded with new business prospects every month.

- Targeted monthly direct mail campaigns customized for your business.

- Dynamic trainings and workshops to launch your business strong and train you to capitalize on cross-selling opportunities for other client savings.

Our workshop training classes have been the most exciting our advisors have ever witnessed, they include:

- Training on how to get past gatekeepers of any size company in the country; one of single greatest marketing techniques we can teach you.

- Our trainer will work one-on-one with you, and actually call some of your provided leads to engage them.

The class action settlement claims consulting services include:

- Providing advisor support in advising next steps for serving the client.

- Preparing, assembling, submitting, and managing client claims packages.

- Providing effective notification of settlements in which clients may be eligible.

Our team tracks many different class actions, currently there are over twenty which total over $8 Billion in potential recoveries in which we are signing up our clients.

Unclaimed Property Recovery

Unclaimed Property assets are abandoned funds or dormant accounts that were with financial institutions or companies but belonged to another company that they once did business with. When there has been no correspondence or business dealings with the rightful property owner for more than two years, by law, the holder of the asset will escheat it to a federal, state or local agency. There is over $58 BILLION being held by agencies across the US, and we have a team that not only specializes in researching where their money is located, but claiming it and getting it back to our clients. We work on a contingency basis, and once a client is onboarded via a fee agreement and some authority documentation, our team handles the entire process. The only time or effort needed from the client is to cash the checks or watch their bank accounts grow when we ACH or wire the money!

Energy Auction

Energy deregulation in the U.S. makes it possible to lower the cost of electricity you get from your supplier in many states. Benefits of our reverse auction model for your business is a 10-20% savings gain with pricing transparency. Through an easy enrollment process that has flexible terms, no switching fees and most importantly no interruption of service. There are no maintenance or hidden fees. Delivery and maintenance will continue to be the responsibility of your local public utility. Our reverse auction process lets you analyze past usage data to apply to guarantee you the best prices for your future electrical needs. This puts you in control allowing you to set your terms through a real-time competitive bidding process that is more effective than conventional paper-based bids.

This service pays every month for as long as the client is on the service.

Shipping

Although a company’s shipping costs may consume five to ten percent of their annual revenue, few companies have the time or tools to effectively manage this expense. Shipping carriers have made this process unnecessarily complex, leading to overspending on shipping and a competitive disadvantage.

We’ve changed the game… introducing a cutting-edge shipping execution platform, at no cost to our clients who qualify, combined with exclusive rates and cost savings strategies that they cannot find anywhere else.

Our system doesn’t simply print labels, it’s a completely automated, multi-carrier shipping technology that continuously optimizes your shipments to identify savings opportunities within your small parcel and LTL shipments. You can keep your current carriers and load them right into our shipping platform.

Our proprietary software, combined with over two hundred million parcels shipped annually, through more than twenty thousand clients, gives you access to rates that companies can only dream of. By using our software, our clients see anywhere from 15% to 40% savings on their shipping spend while enjoying a more efficient and streamlined workflow process in their shipping operations.

Same Day Delivery

A solution that empowers brick-and-mortar retailers to compete in same-day delivery. A low fixed-rate enables retailers of all sizes to cost-effectively satisfy consumer demand for same-day delivery.

Accounts Payable – Virtual Payments

Up until now, the cost of operating a company’s accounts payable function, has been a necessary expense. After all, no one could expect the department that is responsible for making payments, to also generate revenue. That is, up until now.

For businesses that manually process hundreds of invoices each week, the benefits of transitioning to virtual payments is huge. Virtual payments, is not only easier, than checks and ACH, it’s faster. And added speed ultimately means added savings.

Our FREE automated virtual payment solution works with an organizations existing accounting software, streamlines their current procedures, and not only saves: time, money, and paper, but actually pays them a rebate for each virtual payment made.

Our Virtual Payment platform works with their existing accounting software, and there’s no need to change banking relationships. Virtual Payments will save their organization both time and money, and Virtual Payments pays them revenue for every transaction. How much revenue? Every $10 million in Virtual Payments could add $135,000 in additional revenue to their bottom line.

Businesses have to pay your suppliers anyway, so why not turn their Accounts Payable into additional revenue.

Advisors are paid a residual income, on each business, every month they are using virtual payments. You are paid off the transactions not the savings!!!

Zero Cost Processing

For any business that accepts payment for goods or services by credit card, they can now recover back 1% to 4% of their gross sales amount by no longer having to pay for the merchant service processing charges of the transaction.

In the wake of the $5,000,000,000+ class action law suit against the big names in merchant services comes a solution to prevent future overcharging, specifically…don’t be charged at all!

THE RULES HAVE CHANGED for accepting credit cards. Advances in technology, combined with most states in the country which have now approved this, means that companies that sell their goods or services can now apply any merchant processing fees of processing credit cards as a fee to the buyer at time of sale. This is only for processing credit cards, and does not apply to debit card transactions (which have a significantly lower processing cost).

Our special team handles everything needed to properly set up the business to take advantage of this new change, from technology, to disclosure signage, to training of the client and their staff.

Once the client’s company is on this new system the only difference they will notice is an additional 1% to 4% added to the profits of credit card sales.

This is a unique service which is just starting to emerge as an option for businesses in the United States. The advisor is paid a residual income on each business every month they are processing credit card transactions. You are paid off the transactions not the savings!!! Imagine being able to say to your client, “You know those merchant processing fees you have to pay? You don’t have to pay those anymore”. Business owners now have the option to not have to pay merchant processing fees. So we can either lower clients credit card processing fees with our credit card audit program above or with Zero Cost Credit Processing we can eliminate their fees so either way you and your client win.

Class Actions Claims Consulting

One of our newest service additions has become one of the best ways to get in front of business owners anywhere in the country. Class action settlement claims consulting provides your clients with the ability to obtain their fair shares of consumer and antitrust class action recoveries.

Through strategic relationships, we provide:

- Access to a custom CRM which is able to be pre-loaded with new business prospects every month.

- Targeted monthly direct mail campaigns customized for your business.

- Dynamic trainings and workshops to launch your business strong and train you to capitalize on cross-selling opportunities for other client savings.

Our workshop training classes have been the most exciting our advisors have ever witnessed, they include:

- Training on how to get past gatekeepers of any size company in the country; one of single greatest marketing techniques we can teach you.

- Our trainer will work one-on-one with you, and actually call some of your provided leads to engage them.

The class action settlement claims consulting services include:

- Providing advisor support in advising next steps for serving the client.

- Preparing, assembling, submitting, and managing client claims packages.

- Providing effective notification of settlements in which clients may be eligible.

Our team tracks many different class actions, currently there are over twenty which total over $8 Billion in potential recoveries in which we are signing up our clients.

- Specializes in crafting tailored business process automation solutions that evolve with a business.

- Increases productivity by automating repetitive tasks.

- Saves time by accelerating business processes.

- Provides enhanced visibility through automated task allocation, tracking, and monitoring, gaining real-time insights into task statuses.

- Scales as the business grows.

- Requires NO upfront cost or IT resources for implementation.

Unclaimed Property Recovery

Unclaimed Property assets are abandoned funds or dormant accounts that were with financial institutions or companies but belonged to another company that they once did business with.

When there has been no correspondence or business dealings with the rightful property owner for more than two years, by law, the holder of the asset will escheat it to a federal, state or local agency.

There is over $58 BILLION being held by agencies across the US, and we have a team that not only specializes in researching where their money is located, but claiming it and getting it back to our clients.

We work on a contingency basis, and once a client is onboarded via a fee agreement and some authority documentation, our team handles the entire process. The only time or effort needed from the client is to cash the checks or watch their bank accounts grow when we ACH or wire the money!

Energy Auction

Energy deregulation in the U.S. makes it possible to lower the cost of electricity you get from your supplier in many states. Benefits of our reverse auction model for your business is a 10-20% savings gain with pricing transparency.

Through an easy enrollment process that has flexible terms, no switching fees and most importantly no interruption of service. There are no maintenance or hidden fees.

Delivery and maintenance will continue to be the responsibility of your local public utility. Our reverse auction process lets you analyze past usage data to apply to guarantee you the best prices for your future electrical needs. This puts you in control allowing you to set your terms through a real-time competitive bidding process that is more effective than conventional paper-based bids.

This service pays every month for as long as the client is on the service.