SPECIALIZED TAX SAVINGS

Blue Coast Savings Consultants Specialized Tax Savings TMS software and program sources hundreds of tax credits for companies.

- Online platform that puts the power of funding directly into the hands of the client.

- TMS allows businesses to qualify, track, and claim hundreds of tax credits and incentives with one simple login.

- The system works on an ongoing basis, locating and qualifying clients for funding they are missing out, INCREASING THEIR CASH FLOW daily.

- The system works as a business organization tool, keeping the client engaged and allowing us to continually work on their behalf to get the funding on an ongoing basis.

Cost Segregation of Commercial Property

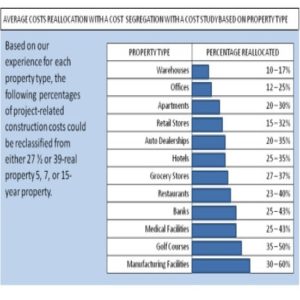

Cost Segregation Studies are one of the most overlooked programs for businesses nationwide and yet the most powerful benefit to commercial property owners. This tax planning strategy identifies and maximizes a client’s tax benefits by accelerating depreciation deductions and deferring tax payments on commercial property. We provide a no-risk upfront assessment to determine if clients qualify. Our team of tax professionals, structural-design experts and engineers identify and re-classify commercial building component expenses.

Engineering based cost segregation studies permit commercial real estate owners to reclassify real property for depreciation purposes and reclassify it as more rapidly depreciating personal property. This reclassification results in significant cash flow benefits in both present and future years through considerably shorter depreciable tax life and accelerated depreciation methods. Note, these studies are not limited to new buildings or new renovations. Over 75% of our projects are on older properties using the “catch up” method which can produce significant results. Although some building owners and CPAs have heard of Cost Segregation, this program is actually an engineering study. Countless building owners are missing out on this powerful tax savings strategy. To facilitate this work we do an initial consultation and develop a feasibility report to determine the cash flow and net present value (NPV) benefit potential. Our professionals evaluate your current tax status and your future business plans along with your CPA to determine if a full study would benefit your company.

The result is an instant tax benefit to the client to offset any taxes they owe; or in some cases, provide much needed cash flow to the business.

“Cost Segregation Studies are a lucrative tax strategy that should be considered in almost every real estate purchase.” -US Treasury Department

Learn More

An IRS approved strategy allowing property owners to reclassify specific assets that currently receive 39 or 27.5 year straight-line depreciation into shorter depreciable lives (5, 7, or 15 year).

Generally, items receiving shorter depreciation are those affixed to the building but not necessarily related to the actual operation and maintenance of the building.

The goal of a proper Cost Segregation Study is to breakdown all assets of a structure and properly allocate each of them to the appropriate depreciable life category. This can only be accurately completed by a professional with in-depth knowledge and experience in the building and/or construction industry.

Any owner of commercial property is a potential candidate for a Cost Segregation study.

On average, for every $1,000,000 in purchase price, construction or renovation cost, a Cost Segregation study will yield accelerated depreciation of approximately $250,000. At a standard effective tax rate, this should yield a cash benefit of $100,000.

Cost Segregation is applicable when constructing a new commercial building, purchasing or renovating an existing one, or possibly even years after selling one.

Yes. According to the IRS Audit Techniques Guidelines, there are five distinct Cost Segregation Methodologies:

- Detailed Engineering Approach

- Survey or Letter Approach

- Residual Estimation Approach

- Sampling or Modeling Approach

- “Rule of Thumb” Approach

As A Blue Coast Advisor you will have access to the highest regarded Cost Segregation Method, the Detailed Engineering Approach. According to the IRS, this approach “is the most methodical and accurate approach” (per IRS Audit Techniques Guide, Chapter 3).

Many rulings over the years have paved the way for what now has become a mainstreamed service in the marketplace. Here is a brief overview of how it has evolved:

1959 – Shainberg v Commissioner

IRS agreed with the court ruling that Cost Segregation is a valid method for building depreciation.

1975 – Whiteco Industries v Commissioner

This ruling provided a form of a checklist to determine how to qualify an asset as “personal property”.

1986 – Investment Tax Credit (ITC):

The ITC is repealed, allowing the newly conceived modified asset cost recovery system (MACRS) to be more favorably adopted for buildings placed in service after 1986. At this time, Residential property depreciation was increased to 27 1/2 years. Commercial Property depreciation increased to 31 1/2 years (and would increase again in 1993 to 39 years).

1997 – Hospital Corporation of America (HCA) v Commissioner:

The landmark case that provided a legal basis for Cost Segregation as a legal methodology for depreciating commercial structures. In this case the HCA disputed many items they deemed were “personal property” and therefore should qualify for accelerated depreciation. The courts agreed with HCA, providing a basic model to classify certain components (electrical wiring for example); allowing for rapid acceleration into a 5 year convention as opposed to 31 1/2 or 39 years. While this was not the only Cost Segregation Case, it is regarded in the industry as the victory which allowed for Cost Segregation to go mainstream.

2004 – Audit Techniques Guide implemented by IRS

An exhaustive document that outlines the facets of a proper Cost Segregation Study and instructs IRS Auditors on how to properly analyze a completed Study. This document has been placed on line for all to see at http://www.irs.gov/Businesses/Cost-Segregation-Audit-Techniques-Guide—Table-of-Contents

- Fifty Page Final Engineering Report

- Executive Summary of Findings

- PDF Exhibits with all Asset Breakdowns

- Detailed Property Description

- Unlimited Audit Defense Certificate

- Numerous Pictures of Facility to Substantiate Findings

- Applicable Case Law

- Unlimited CPA Consulting

Frequently Asked Questions by Prospective Clients

CPA’s are tax return specialists not Engineers.

Cost Segregation is a specialized engineering-based service that must be handled by a specialist.

The CPA/client relationship is quite similar to the family doctor/patient relationship. The family doctor is a “general practitioner” but not a “specialist”. Just as when a specific condition is suspected by the family doctor, they will refer the patient to a specialist in the particular area of ailment; we are the specialist for the ailment of paying too much in taxes!

No. IRS Revenue Procedure 96-31 allows a taxpayer to file a form 3115 Automatic Change in Accounting rather than an amended tax return. Although many CPA’s are still unaware of this option, it is clearly defined by the IRS and is the preferred method to utilize the benefits of Cost Segregation.

No. Cost Segregation is backed by the Supreme Court, the IRS, and extensive case law. A cost segregation study will not trigger an audit as long as it is completed by experienced professionals using IRS approved techniques.

If the IRS chooses to review our Cost Segregation findings, we will defend our findings in front of the IRS at no cost to the client. We call this “100% Audit Defense” which is inclusive in all of our studies.

R&D Tax Credits

The Research & Development Tax Credit was originally enacted as a Federal Tax Program in 1981 and was designed to encourage American investment in innovation. In 2004, tax regulation changes significantly expanded this credit opportunity which is available to many small and medium sized companies whose activities include design, manufacturing and process improvements. Companies that qualify for this program get significant tax credits based on activities related with developing or improving a product and/or process. Our team of highly qualified professionals which includes IP attorneys with engineering backgrounds, adheres to the Comprehensive Project by Project Approach methodology required by the IRS. By following this methodology, we qualify every applicable employee, activity, hour spent and corresponding wage paid in order to maximize the incentive for you. We strictly adhere to the applicable sections of the code and provide comprehensive documentation to substantiate our findings. The PATH Act of 2015 made some very exciting changes to this program and also made them permanent. The best part is this service pay every single year with major benefits for your client.

“The R&D credit is designed to spur growth through innovation by enabling taxpayers with research-related expenditures to receive a credit against their regular income tax liability”-American Institute of CPA’s (AICPA)

The benefits of having an R&D Tax Credit Study performed would be:

- Dollar for dollar credit against taxes owed or previously paid

- Carry forward credit for future profitable years

- Immediate increase in company cash flow

Learn More

To put it simply, the R&D Tax Credit is a tax incentive for U.S. companies to increase their research and development activities. Although the R&D is a Federal tax program, many states have chosen to include a state program as an additional incentive to its business owners.

In the marketplace, the Credit is known by three main names:

- R&D Credit

- Section 41 Credit

- Research Credit

The goal of a proper R&D Tax Credit study is to breakdown all applicable wages and costs incurred by a company and segregate those designated as Qualified Research Expenses (QRE’s). The tax credit to the company is a direct factor of the amount of eligible QRE’s.

Companies with U.S. based operations that perform one or more of the following operations:

- Manufacturing

- Fabrication

- Engineering

- New Product & Process Development

- Developing New Concepts or Technologies

- Design and Testing

- Prototyping or Modeling

- Software Development or Improvement

- Integration of new machinery

- Automation of internal processes

- Developing tools, molds, and/or dies

- Developing or applying for Patents

On average, for every $1,000,000 in total company payroll, there would be a gross credit of approximately $20,000 to $40,000. Additionally, companies who have not yet taken the credit are eligible to capture missed credits from the prior three years.

A company with U.S. based activities as listed above qualify for the R&D tax credit.

The IRS allows two different methods of capturing the credit.

- Regular Research Credit (RRC)

This is the larger version of the Credit and requires more detailed documentation in order to satisfy the IRS R&D review board. According to the Journal of Accountancy, “The RRC is an incremental credit that equals 20% of a taxpayer’s current-year QRE’s that exceed a base amount, which is determined by applying the taxpayer’s historical percentage of gross receipts spent on QRE’s (the fixed-base percentage) to the four most recent years’ average gross receipts”.

If it sounds complicated, that is because it is. This is why companies need to hire an expert third party to handle all the intricacies of the Credit. The RRC is complicated but can yield substantial credits when completed properly.

- Alternative Simplified Credit (ASC)

While not necessarily simple, the ASC is simpler than the RRC; by a significant degree. Since 2007 business owners have been able to elect the ASC method and receive a slightly lower benefit when compared with the RRC (14% of QRE’s as compared to 20%).

The ASC is not available for prior tax year studies, as the election must be claimed on the original tax return. Companies will therefore frequently elect the ASC method for the current year R&D Credit study, and the RRC for prior years.

As a Blue Coast Advisor you will have access to a full team of R&D Tax Credit experts. This team includes Engineers and Attorneys who spend 100% of their time completing R&D Tax Credit studies for eligible companies across the nation.

The R&D Tax Credit is one of the most misunderstood and under-utilized credits, mostly due to the litany of changes it has undergone. Since 1981 there have been no fewer than eight expirations and fifteen extensions of the credit. Here is a brief overview of how we got where we are today:

1981 – The Economic Recovery Tax Act (ERTA)

The initial “stimulus package”, put in place to stimulate investment in research spending. Under the ERTA, the “Credit for Increasing Research Activities” was introduced. This was the initial R&D Tax Credit.

1986 – The Tax Reform Act of 1986

The first major set of revisions to the R&D Tax Credit was introduced, specifically as it related to defining “Qualified Research”. This would be the first of many revisions and updates.

2004 – Audit Techniques Guide Introduced

When it comes to a complicated, self-directed tax credit, the IRS needed to ensure companies were not taking advantage. In 2004, they introduced the Audit Techniques Guide to assist Auditors in their examinations. IRS examiners would now have a detailed guide on how to review R&D Tax Credit studies.

2005 – Revisions to the Audit Techniques Guide

In June of 2005, the IRS instituted a much more thorough guide to its examiners to assist them in their R&D Credit reviews.

2008 – Passing of the Emergency Economic Stabilization Act

This Act extended the Tax Credit for two years and increased the Alternative Simplified Credit (ASC) to 14% for tax years ending after Dec. 31, 2008.

2010 – Passing of the Small Business Jobs Act

This Act enhanced the ability of many businesses to capture the R&D Tax Credit by allowing the Credits to offset regular tax and the Alternative Minimum Tax (AMT). Unutilized credits can be carried back five years and carried forward twenty years without being subject to the AMT limitation. Prior to the Small Business Jobs Act, businesses paying AMT were essentially unable to utilize the benefits of R&D Tax Credits.

2012 – Passing of the American Taxpayer Relief Act

This Act retroactively reinstated the R&D Tax Credit, which had expired on Dec. 31, 2011.

2015 – Passing of the Protecting Americans from Tax Hikes Act of 2015 (PATH Act)

This Act officially makes the Credit for Increasing Research Activities (The R&D Credit) permanent for the first time and contains several modifications. Small businesses are now eligible to use the R&D Credit against Alternative Minimum Tax (AMT). This means that many companies that previously had no utilization for the R&D Credit will suddenly find it available to them. In addition qualified small businesses will be allowed to elect to use the credit against payroll taxes.

- Fifty Page Final Engineering Report

- Completed 6765 IRS Tax Form

- Qualified Research Expenditure (QRE) Summary

- Detailed Overview of Qualified Client Processes

- Unlimited Audit Defense Certificate

- In-depth Engineering Analysis of Activities

- Substantive Pictures & Diagrams Substantiate Findings

- Applicable Case Law

- Unlimited CPA Consulting

Frequently Asked Questions by Prospective Clients

CPA’s are tax return specialists, not Engineers and Attorneys. CPA’s lack the proper expertise and experience in breaking down a company’s operations and processes in order to capture this extremely complicated tax incentive.

For “current” tax years the R&D Tax Credit is captured by including IRS tax form 6765 into the current tax return. The credit to the business is a dollar-for-dollar reduction of taxes owed.

For “prior” years, also called “retro” years, the business will amend prior year tax returns in order to receive the credit. Note the statute of limitations on capturing prior year credits is three open tax years.

No. R&D audit reviews are handled by a separate authority and should never trigger a general business audit. There is a chance R&D Credits will be reviewed, which is why free “audit defense” is so important when choosing an R&D Tax Credit provider.

If the IRS chooses to review our R&D Tax Credit findings, we will defend our findings in front of the IRS at no cost to the client. We call this “100% Audit Defense”, which is inclusive in all of our studies.

Hiring Tax Incentives

Many employers are not aware of the many tax incentive programs available to help companies hire and keep employees. Our hiring specialists review more than 90 such programs to determine the eligibility of current and future employees in order to assess potential for tax credits.

Hiring tax incentives are available to companies that are growing and creating net new jobs; companies that are experiencing a high turnover in a given year; as well as companies that have seasonal employment swings such as retail chains, warehouses, manufacturers, restaurants, hotels and motels. Our experts are here to provide guidance on how to maximize the incentives you receive when hiring new employees; summer youths, new adults, new disabled veterans as well as benefits for each new long term family assistance recipient hired over a two year period. Some of the programs that we look into on your behalf are the Work Opportunity Tax Credit, Hiring Incentives Restore Employment Act and the Small Business Jobs Act. The workers opportunity tax credit allows employers to earn between $2,400 and $9,600 for each eligible employee they hire. The PATH Act of 2015 has significantly expanded the platform of Hiring Incentives. Local, state, and federal tax incentive programs allow employers to reduce taxable liability of private-for-profit employers for the hiring of qualified individuals.

What makes us different is we tell the employer BEFORE they select someone for the position if their likely to qualify. Putting the power in the employers hands. We do this by using an algorithm that searches hundreds of local, state, and federal program qualifications in real time…. DURING THE APPLICATION PROCESS. That’s right, while a candidate is filling out the online application our system is doing a search in the background to see which programs that candidate is likely to qualify for. Giving the employee instant feedback on if they’re likely to review a tax credit if they hire this employee.

Property Tax

Outside of income taxes, the single largest recurring charge for commercial property owners are property taxes. Every property owner feels they are overpaying on their property tax. In most states, owners are required to pay taxes on both their real estate as well as their personal property. These charges are often an immense expense and a constant hit to the bottom line. To ensure you are not being overcharged on your property taxes, a specialist with extensive market experience in valuation, tax, and law is needed. Our experienced team of professionals in mitigation, valuation, assessments, and law will work on your case to identify any potential opportunity for refunds and/or reductions in your current property taxes. We perform all the work on your behalf until savings are captured, including partaking in hearings and filing necessary paperwork. We act as an extension of your company toward the governing property tax bodies.